Candlestick patterns is one of the best trading method of forex trading. Every trader and investor should know what is candlestick patterns & how it works. Before we know what is the Japanese candlestick chart pattern, we need to know how many price charts has on the forex platform. Forex trading platform has many price chart but the Japanese candlestick price chart is the most popular and easy price chart for traders and investors. Let's we know a few forex trading price chart name:

1. Line Chart

2. Bar Chart

3. Candlestick Chart

4. Volume Chart

5. Tick Chart

7. Point & Figure Chart

9. Kagi Chart

10. Three-Line Break Chart

We see the Line chart, Bar chart & Candlestick chart in metatrader 4 & metatrader 5. In this tutorial, we will learn only the candlestick price chart and candlestick pattern.

What is the candlestick price chart?

Candlestick chart is a great market price watch tool. We see the current market price clearly by the candlestick price chart. when the market price moves up then makes a bullish candlestick candle and when the market price goes down then makes a bearish candlestick candle.

How to read Japanese candlestick patterns?

A candlestick has opening price, closing price, higher price, lower price. Candlesticks are two types. Bullish candlestick and bearish candlestick. The default color of the bullish candlestick is green and bearish candlestick is red. But many traders and investors use white and black color for bullish candlestick and bearish candlestick. I'm also using white & black color in this tutorial.

Bullish Candlestick:

|

| Bullish Candlestick |

- Color white.

- The closing price is greater than the opening price.

- The highest price is greater than the closing price.

- the lowest price is less than the opening price.

Bearish Candlestick:

|

| Bearish Candlestick |

- Color Black.

- The closing price is less than the opening price.

- The lowest price is less than the closing price.

- The highest price is greater than the opening price.

Parts Of Candlestick:

Do you know how many parts of a candlestick? Naturally, a candlestick has three parts. Those are Upper shadow, lower shadow & body.

Upper shadow:

|

| Bullish Candlestick Upper Shadow |

In a bullish candlestick, the upper shadow is the difference between a closing price and the highest price. Upper shadow isn't compulsory. A bullish candlestick's maybe has an upper shadow or not.

Explain:

Bullish Upper Shadow = Highest Price - Closing Price

= 18.330 - 18.230

= 100 Pips

|

| Bearish Candlestick Upper Shadow |

In a bearish candlestick, the upper shadow is the difference between the highest price & the opening price. Upper shadow isn't compulsory. A bearish candlestick maybe has an upper shadow or not.

Explain:

Bearish Upper Shadow = Opening price - Highest price

= 18.230 - 18.330

= -100 pips

Lower Shadow:

|

| Bullish Candlestick Lower Shadow |

In a bullish candlestick, the lower shadow is the difference between the lowest price and the opening price. Lower shadow isn't compulsory. A bullish candlestick's maybe has a lower shadow or not.

Explain:

Bullish Lower Shadow = Opening Price - Lowest Price

= 18.230 - 18.130

= -100 pips

|

| Bearish Candlestick Lower Shadow |

In a bearish candlestick, the lower shadow is the difference between the lowest price & the closing price. Lower shadow isn't compulsory. A bearish candlestick maybe has a lower shadow or not.

Explain:

Bearish Lower Shadow = Closing Price - Lowest price

= 18.230 - 18.130

= 100 Pips

Body:

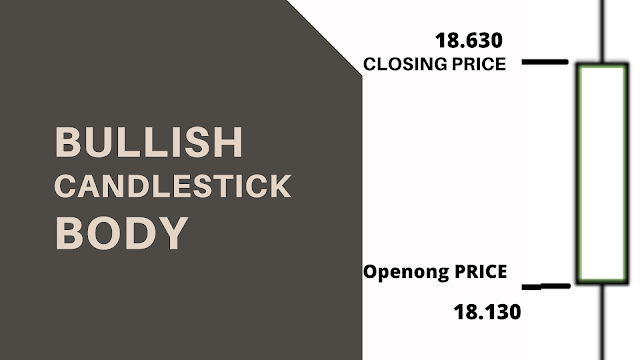

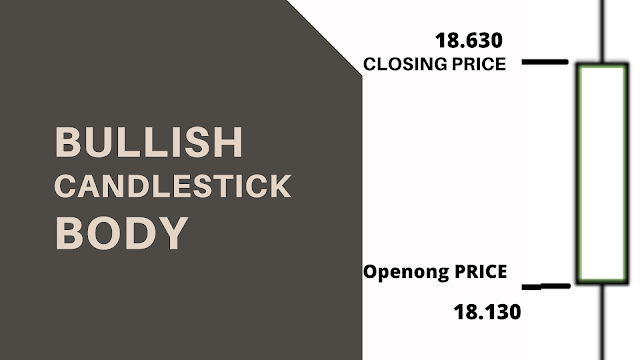

|

| Bullish Candlestick Body |

In a bullish candlestick's, the body is the difference between an opening price & the closing price. A bullish candlestick must have a body.

Explain:

Bullish Body = Closing Price - Opening Price

= 18.630 - 18.130

= 500 pips

|

| Bearish Candlestick Body |

In a bearish candlestick, the body is the difference between an opening price & the closing price. A bearish candlestick must have a body.

Explain:

Bearish body = Opening Price - Closing Price

= 18.630 - 18.130

= - 500 Pips

Bullish Marubozu Candlestick Patterns

|

| Bullish Marubozu Candlestick Patterns |

- It looks like a capital I letter.

- Color white.

- Marubozu has no upper shadow.

- It has no Lower shadow.

- Bullish Marubozu must has a big white body.

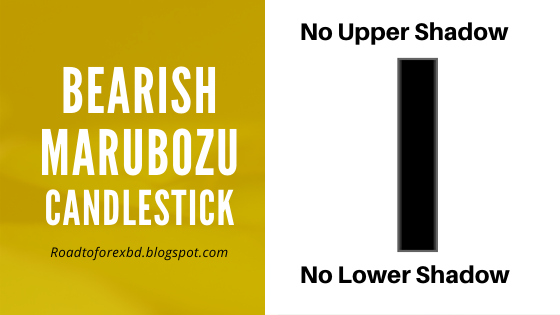

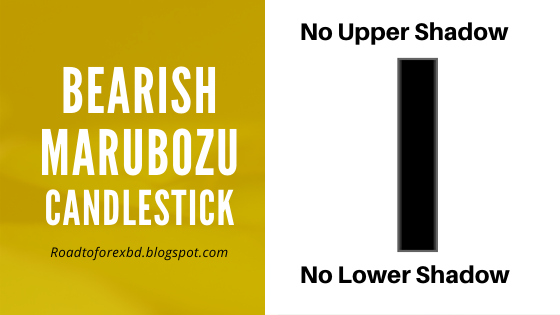

Bearish Marubozu Candlestick Patterns

|

| Bearish Marubozu Candlestick Patterns |

- It also looks like a capital I letter.

- Color black.

- Marubozu has no upper shadow.

- It has no Lower shadow.

- Bearish Marubozu must has a big black body.

Bullish Engulfing Candlestick Patterns

|

| Bullish engulfing candlestick patterns |

- It requires two candlesticks.

- The first candlestick is a small bearish candlestick.

- The second candlestick is a large bullish candlestick.

- The second bullish candlestick's open from a new lower price and close a higher price than the first bearish candlestick.

- Naturally, a candlestick opens from the previous candlestick's closing price.

- But in this pattern's second candlestick open from a new lower price than first candlestick's closing price.

Explain:

- Bullish candlestick's opening price must be less than the first bearish candlestick's closing price

- Bullish candlestick's closing price must be greater than the first bearish candlestick's opening price.

Bearish Engulfing Candlestick Patterns:

|

| Bearish engulfing candlestick pattern |

- It also requires two candlesticks.

- The first candlestick is a small bullish candlestick.

- The second candlestick is a large bearish candlestick.

- The second bearish candlestick's open from a new higher price and close a lower price than the first bullish candlestick.

- Naturally, a candlestick opens from the previous candlestick's closing price.

- But in this pattern's second candlestick open from a new higher price than first candlestick's closing price.

Explain:

- Bearish candlestick's opening price must be greater than the first bullish candlestick's closing price.

- Bearish candlestick's closing price must be less than the first bullish candlestick's opening price.

Dragonfly Doji

|

| The Dragonfly Doji |

- Dragonfly Doji is a clear reversal pattern.

- It appears near a support level of a downtrend bottom.

- It looks like a Capital T letter

- The opening, closing and highest prices are the same.

- It has no real body but a long lower shadow.

- When a Dragonfly Doji appears at bottom of a downtrend then traders and investors close their sell position because price moves down to up shortly.

Gravestone Doji

|

| The Gravestone Doji |

- Gravestone Doji is a clear reversal pattern.

- It appears near a resistance zone of an uptrend top.

- It looks like an inverted capital T letter.

- The opening, closing and highest prices are the same.

- It has no real body but a long upper shadow.

- When a Gravestone Doji appears on top of an uptrend then traders and investors close their buy position because price moves up to down shortly.

Neutral Doji

|

| Neutral Doji |

- It has no real body.

- Neutral Doji is a continuation pattern.

- Ideally, the opening price and closing price both the same for a neutral Doji but this doesn't always happen. If the opening price and closing price are the same, the Neutral Doji's have a greater importance.

- Higher price is equal to lower price

- Color doesn't matter.

Read: How to make money using

DOJI candlestick patterns

Long-leged Doji

|

| Long-leged Doji |

- The Long-Leged Doji has a long upper shadow and lower shadow.

- The opening price and closing price are the same.

- It has no real body.

Hammer

|

| Hammer |

- The hammer appears at the bottom of a downtrend.

- It looks like a square lollipop with a long stick.

- The closing price is above or near the opening price, forming a tiny body.

- The real body could be white or black.

- Color doesn't matter.

- It has no or little upper shadow.

- The lower shadow must be at least twice the length of the real body.

Shooting Star

|

| Shooting Star |

- The shooting star appears on top of an uptrend.

- It looks like a flying meteor carrying a long tail

- The closing price is above or below or near the opening price, forming a tiny body.

- The real body could be white or black.

- Color doesn't matter.

- It has no or little lower shadow.

- The upper shadow must be at least twice the length of the real body.

Piercing candlestick Patterns

|

| Piercing Candlestick Patterns |

- It appears at the bottom of a downtrend.

- It needs two strong candlesticks.

- The first candlestick is a strong bearish candlestick.

- The second bullish candlestick appears at the bottom of the downtrend by creating a new closing price.

- Second bullish candlestick's closing price above the middle of the first bearish candlestick.

- Naturally, a candlestick opens from the previous candlestick's closing prices. But in this pattern, the second candlestick opens from a new lower price than the first candlestick's closing prices.

Read: How to make money using

PIERCING candlestick patterns

Dark cloud cover Candlestick Patterns

|

| Dark Cloud Cover Candlestick Pattern |

- It appears on the top of an uptrend.

- It needs Two strong candlestick.

- The first candlestick is strong Bullish.

- The Second candlestick is strong Bearish.

- The Second Bearish candlestick appears on the top of the uptrend by creating a new high opening price.

- Second candlestick's closing price above the middle of the first Bullish candlestick's.

- Naturally, a candlestick opens from the previous candlestick's closing prices. But in this pattern, the second candlestick opens from a new higher price than the first candlestick's closing prices

Tweezer Bottom Candlestick Patterns

- It appears at the bottom of a downtrend.

- It needs Two strong candlestick equal candlestick.

- The first candlestick must be bearish ( Black Candlestick ).

- Second Candlestick Must be a bullish candlestick ( White Candlestick ).

- A white candlestick followed by a black candlestick.

- Both candlesticks have the same low and high prices.

Tweezer Top Candlestick Patterns

- It appears on top of an uptrend.

- It needs Two strong candlestick equal candlestick.

- The first candlestick must be bullish ( White Candlestick ).

- Second Candlestick Must be a bearish candlestick ( Black Candlestick ).

- A black candlestick followed by a white candlestick.

- Both candlesticks have the same low and high prices.

Bullish Abandonedbaby Candlestick Patterns

|

| Bullish Abandoned Baby Candlestick Pattern |

- It needs three candlestick

- The first candlestick is strong bearish

- The second candlestick is absolutely Doji candlestick ( color doesn't matter ) formed below first bearish candlestick falling a gap.

- The third candlestick is an absolutely strong Bullish candlestick.

- The third candlestick appears above the Doji rising up making the same gap.

- Third candlestick's opening price near the first candlestick's closing price

- Third candlestick's closing price above the middle of the first candlestick

Read: How to make money using

BULLISH candlestick patterns

Bearish Abandoned Baby Candlestick Patterns

|

| Bearish Abandoned Baby Candlestick Pattern |

- It looks like an umbrella.

- It needs Three candlestick like Bullish abandoned baby candlestick.

- The first candlestick is strongly bullish.

- The second candlestick must be Doji candlestick ( color doesn't matter ).

- The Doji candlestick must appear on top of the first bullish candlestick.

- The Doji candlestick appears on top by creating a gap.

- The third candlestick must be a strong bearish candlestick.

- The third candlestick appears above the Doji rising up making the same gap.

- Third candlestick's opening price near the first candlestick's closing price.

- Third candlestick's closing price above the middle of the first candlestick.

Read This: How to make money with

BEARISH Abandoned Baby Candlestick Patterns

Three White shoulder

No comments